Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Blog Article

The Definitive Guide to Mileagewise - Reconstructing Mileage Logs

Table of ContentsExcitement About Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs 9 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe 6-Second Trick For Mileagewise - Reconstructing Mileage Logs

The NSA. Facebook. Big Brother. People staying in the 21st century encounter an unprecedented understanding of means they can be kept an eye on by powerful companies. No one desires their manager contributed to that checklist. Or do they? An independent study performed by TSheets in 2016 located that just 5% of employees that had actually been tracked by employers utilizing a general practitioner system had a negative experience.(https://mi1eagewise.blog.ss-blog.jp/2024-11-21?1732177164)In 2019, mBurse surveyed mobile employees concerning GPS monitoring and discovered that 81% would certainly sustain their employer tracking their company gas mileage if it suggested getting complete reimbursement of lorry expenses. In general, while some employees express problems about micromanagement and being tracked after hours, those who have been tracked locate those problems mainly eased.

In order to realize the benefits of general practitioner gas mileage logs without driving workers out the door, it is essential to select an ideal GPS application and institute guidelines for appropriate usage. Drivers need to be able to edit journeys and assign specific sections as individual to make sure that no information about these trips will be sent to the employer.

Some Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Motorists need to likewise have the ability to shut off the application if essential. Simply due to the fact that you have information on your staff members' whereabouts during business travel does not mean you have to have a conversation regarding every information - mileage log for taxes. The main objective of the general practitioner application is to provide exact gas mileage monitoring for reimbursement and tax obligation purposes

It is common for many organizations to keep an eye on workers' usage of the web on firm devices. The easy truth of keeping track of dissuades ineffective web usage with no micromanagement.

There's no refuting there are a number of advantages to tracking gas mileage for company. Yet, there's additionally no sugar-coating that it can use up a fair bit of time to do so manually. We obtain it as a local business proprietor, you currently have a continuous order of business. Unless you're tracking mileage for compensation objectives, exercising exactly how to track gas mileage for job trips might not really feel like a critical task.

Mileagewise - Reconstructing Mileage Logs - Questions

The charm of digital tracking is that every little thing is recorded. In enhancement to maximizing your tax obligation reductions by offering journey details and timestamps with identify accuracy, you can get rid of detours and unauthorized personal journeys to enhance employee accountability and performance. Looking for a thorough remedy to aid manage your overhead? We can aid! At Roll, we recognize that remaining on top of administrative tasks can be tough.

Have you experienced the pain of looking at business trips carefully? The complete miles you drove, the fuel sets you back with n variety of various other expenses., time and again. Generally, it takes nearly 20 hours each year for a bachelor to log in their mile logs and other expenses.

Some Known Facts About Mileagewise - Reconstructing Mileage Logs.

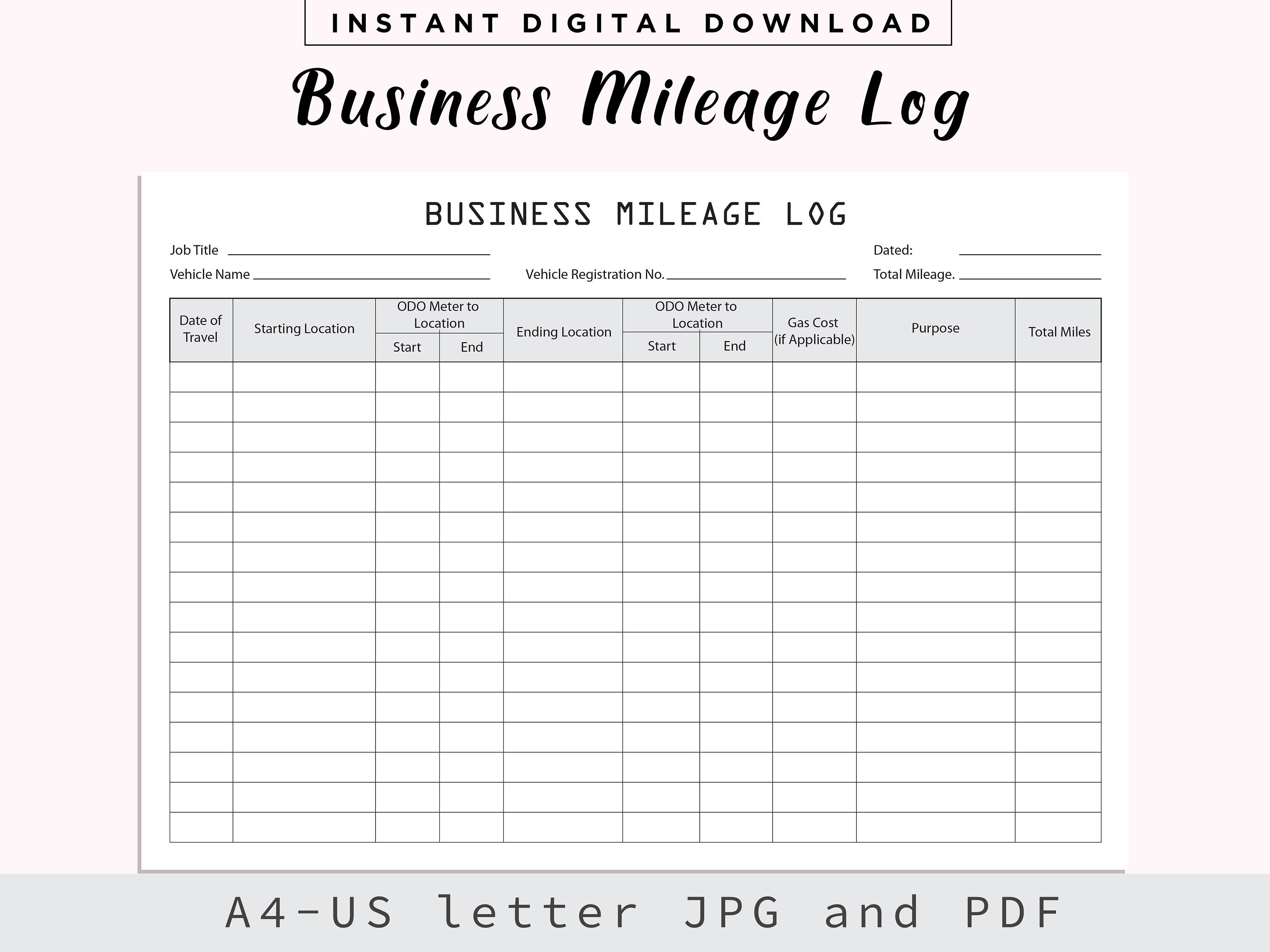

Now comes the primary photo, tax obligation reduction with gas mileage tracker is the talk of the area. free mileage tracker app. In information listed below, we have actually explained the 2 ways by which you can assert tax obligation- reduction for the business miles travelled.

For your convenience, we have created the listing of requirements to be taken into consideration while selecting the ideal gas mileage monitoring application. Automation being an essential consider any kind of service, see to it to select one that has actually automated types which can compute expenditures promptly. Constantly try to find added functions provided, such as the amount of time one has functioned as in the latest applications.

Excitement About Mileagewise - Reconstructing Mileage Logs

The information is constantly offered to you on your mobile phone to review, modify and edit at any moment. These apps are straightforward and simple to make use of. They assist you conserve time by determining your gas mileage and maintaining a record of your data. Therefore, Gas mileage tracker apps like Just Auto assistance not just maintaining the mile logs however additionally with the compensation of organization miles.

The Mileagewise - Reconstructing Mileage Logs Ideas

federal government firm accountable for the collection of tax obligations and enforcement of tax obligation regulations. Developed in 1862 by Head Of State Abraham Lincoln, the firm governs under the authority of the United States Department of the Treasury, with its primary purpose making up the collection of private earnings taxes and employment tax obligations.

Apple iOS: 4.8/ Google Play: 3.5 Stride is a free gas mileage and expense-tracking application that collaborates with Stride's various other services, like medical insurance and tax-prep assistance. In addition to offering websites to Stride's other items, it provides a mileage and expense-tracking feature. I was able to download and install and set up the application quickly and quickly with both my iPhone and a Galaxy Android tablet computer.

While the premium application uses to connect to your bank or charge account to streamline expensing, it won't connect to your Uber/Lyft accounts. My (minimal) screening of Everlance revealed very comparable gas mileages to Google Maps, so accuracy needs to get on par with the rest of the applications. simple mileage log. Generally, I assumed Everlance was well-executed and this hyperlink simple to use, however the attributes of the free and also exceptional versions simply didn't come up to some of the other applications'

Report this page